The Anatomy of a Blockchain Scam: Case Studies

- Unveiling the Dark Side: How Blockchain Scams Operate

- Case Study Insights: Dissecting Notorious Blockchain Frauds

- From Hype to Heist: The Anatomy of Blockchain Scams

- Lessons Learned: Real-World Examples of Blockchain Deception

- Inside the Mind of a Scammer: Blockchain Edition

- Protecting Your Investments: Recognizing Blockchain Scam Tactics

Unveiling the Dark Side: How Blockchain Scams Operate

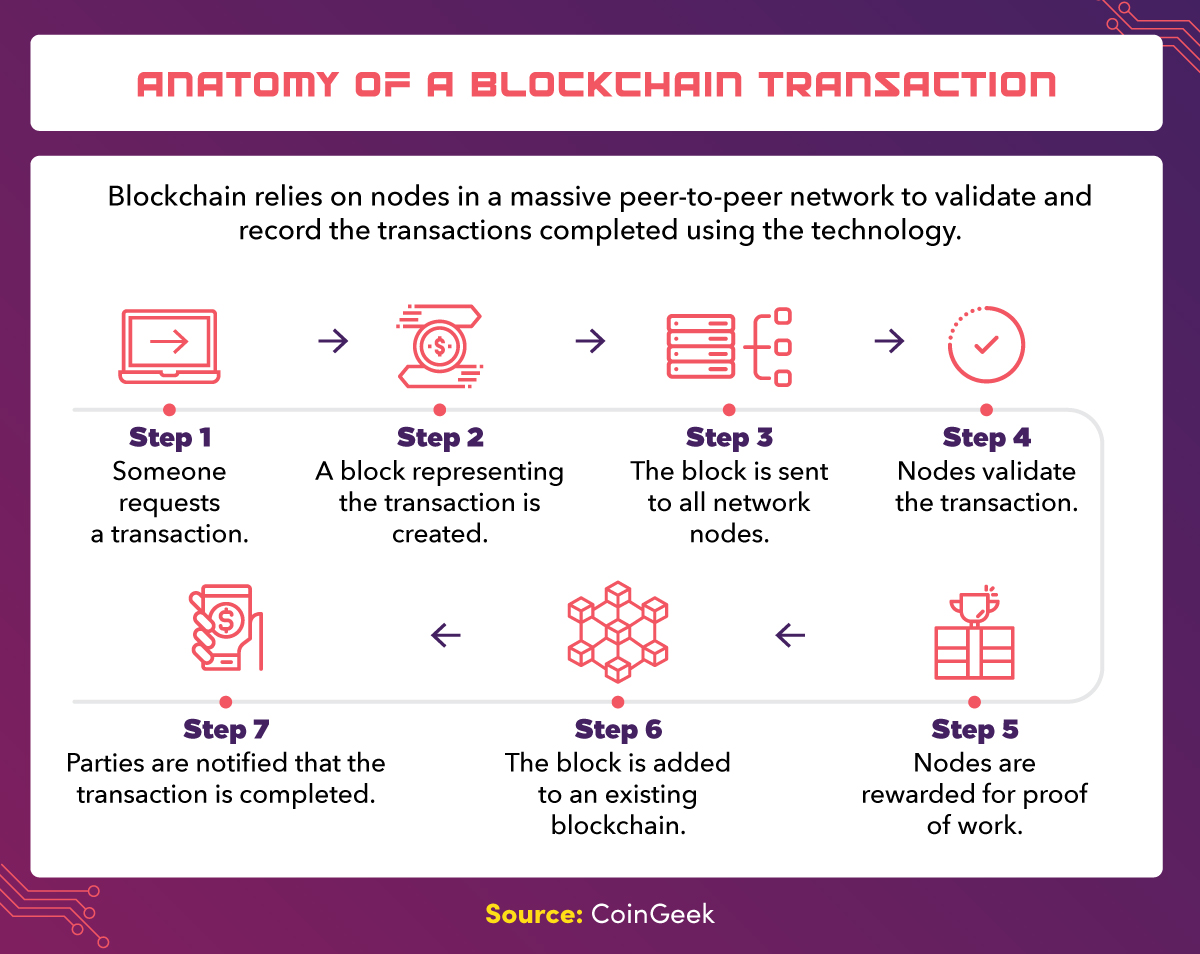

Blockchain technology has revolutionized various industries, offering transparency, security, and decentralization. However, this innovation has also given rise to numerous scams that exploit the unsuspecting. Understanding how these fraudulent schemes operate is crucial for safeguarding investments and maintaining trust in the blockchain ecosystem.

One common method used by scammers is the Initial Coin Offering (ICO) scam. In this scheme, fraudsters create a seemingly legitimate project and offer tokens to investors in exchange for established cryptocurrencies like Bitcoin or Ethereum. These projects often promise high returns and revolutionary technology but disappear once they have collected substantial funds.

Another prevalent scam is the phishing attack. Scammers send emails or messages that appear to be from reputable blockchain companies, urging recipients to provide private keys or personal information. Once the information is obtained, the fraudsters gain access to the victim’s digital wallet and steal their assets.

Ponzi schemes are also rampant in the blockchain space. These scams promise high returns with little risk, attracting new investors to pay returns to earlier investors. Eventually, the scheme collapses when there are not enough new investors to sustain the payouts, leaving many with significant losses.

Fake exchanges and wallets are another tactic used by scammers. They create counterfeit platforms that mimic legitimate ones, tricking users into depositing their funds. Once the funds are deposited, the scammers shut down the fake platform, taking the assets with them.

Lastly, pump and dump schemes are a common manipulation tactic. Scammers artificially inflate the price of a cryptocurrency through misleading statements and hype. Once the price reaches a peak, they sell off their holdings, causing the price to plummet and leaving other investors with worthless tokens.

To protect against these scams, it is essential to conduct thorough research, verify the legitimacy of projects, and remain cautious of offers that seem too good to be true. By understanding the mechanisms behind these fraudulent activities, investors can better navigate the blockchain landscape and make informed decisions.

Case Study Insights: Dissecting Notorious Blockchain Frauds

Blockchain technology has revolutionized various industries, but it has also become a fertile ground for fraudulent activities. Understanding the anatomy of blockchain scams through case studies provides valuable insights into how these schemes operate and how they can be avoided.

One of the most notorious blockchain frauds is the **Bitconnect** scam. Bitconnect promised high returns through a lending program, attracting thousands of investors. However, it turned out to be a Ponzi scheme, where returns were paid from new investors’ funds rather than from profit. The collapse of Bitconnect resulted in significant financial losses for many participants.

Another infamous case is the **OneCoin** scam. Marketed as a revolutionary cryptocurrency, OneCoin lured investors with promises of high returns and exclusive access to a new digital currency. In reality, OneCoin had no blockchain and was a pyramid scheme. The founders were eventually arrested, but not before defrauding investors of billions of dollars.

The **Mt. Gox** incident is another significant example. Once the largest Bitcoin exchange, Mt. Gox suffered a massive hack in 2014, leading to the loss of 850,000 Bitcoins. The exchange’s poor security measures and lack of transparency were major factors in the breach, highlighting the importance of robust security protocols in the blockchain space.

**PlusToken** is another case that shook the blockchain community. Promising high returns through a wallet service, PlusToken amassed over $2 billion from investors. However, it was later revealed to be a Ponzi scheme, and the operators disappeared with the funds, leaving investors in the lurch.

These case studies underscore the importance of due diligence and skepticism when dealing with blockchain investments. Investors should be wary of promises of guaranteed returns and should thoroughly research any platform or service before committing funds. By learning from these notorious frauds, the blockchain community can better protect itself against future scams.

From Hype to Heist: The Anatomy of Blockchain Scams

Blockchain technology has garnered significant attention for its potential to revolutionize various industries. However, this excitement has also paved the way for numerous scams. Understanding the anatomy of these fraudulent schemes is crucial for investors and enthusiasts alike.

One common tactic involves creating a sense of urgency and exclusivity. Scammers often launch Initial Coin Offerings (ICOs) with promises of high returns and limited-time offers. These ICOs are typically accompanied by professional-looking websites and whitepapers that detail the supposed benefits of the new cryptocurrency. However, once the funds are collected, the perpetrators disappear, leaving investors with worthless tokens.

Another prevalent method is the Ponzi scheme, where returns are paid to earlier investors using the capital from newer participants. This creates an illusion of profitability and attracts more victims. Eventually, the scheme collapses when the influx of new investments slows down, resulting in significant losses for the majority of participants.

Phishing attacks are also a common threat in the blockchain space. Scammers send emails or messages that appear to be from legitimate cryptocurrency exchanges or wallet providers. These communications often contain links to fake websites designed to steal login credentials and private keys. Once the scammers gain access, they can drain the victim’s digital assets.

Fake exchanges and wallets represent another layer of deception. These platforms lure users with attractive features and low fees. However, once users deposit their funds, they find it impossible to withdraw them. The operators of these fake services then vanish, taking the deposited cryptocurrencies with them.

Lastly, pump-and-dump schemes are rampant in the cryptocurrency market. In these scenarios, a group of individuals artificially inflates the price of a low-value coin through coordinated buying. Once the price reaches a certain level, they sell off their holdings, causing the price to plummet and leaving other investors with significant losses.

To protect against these scams, it is essential to conduct thorough research and due diligence. Verify the legitimacy of ICOs, exchanges, and wallets by checking for regulatory compliance and user reviews. Be wary of unsolicited communications and always double-check URLs before entering sensitive information. By staying informed and cautious, one can navigate the blockchain landscape more safely.

Lessons Learned: Real-World Examples of Blockchain Deception

Blockchain technology has revolutionized various industries, but it has also become a fertile ground for scams. Understanding real-world examples of blockchain deception can help in identifying and avoiding such fraudulent schemes. Here are some notable cases that highlight the lessons learned from blockchain scams.

- Bitconnect: Bitconnect was a cryptocurrency lending platform that promised high returns on investments. It turned out to be a classic Ponzi scheme, where returns were paid from new investors’ funds rather than from profit. The collapse of Bitconnect resulted in significant financial losses for many investors. The key lesson here is to be wary of platforms that guarantee unusually high returns with little to no risk.

- OneCoin: Marketed as a revolutionary cryptocurrency, OneCoin was nothing more than a multi-level marketing scam. The founders claimed that OneCoin would surpass Bitcoin, but in reality, there was no blockchain technology behind it. Investors were lured by the promise of massive profits, only to find out that the entire operation was fraudulent. This case underscores the importance of verifying the technological foundation of any cryptocurrency.

- Mt. Gox: Once the largest Bitcoin exchange, Mt. Gox suffered a massive hack that led to the loss of 850,000 Bitcoins. The exchange’s poor security measures and lack of transparency were major factors in the breach. This incident highlights the necessity of using secure and transparent platforms for cryptocurrency transactions.

- PlusToken: PlusToken was a wallet and investment platform that promised high returns through a combination of cryptocurrency trading and mining. It turned out to be one of the largest Ponzi schemes in the crypto world, defrauding investors of billions of dollars. The PlusToken scam teaches the importance of due diligence and skepticism towards platforms that offer guaranteed returns.

These examples illustrate that while blockchain technology offers numerous benefits, it also presents opportunities for deception. Investors should conduct thorough research, verify the legitimacy of platforms, and be cautious of promises that seem too good to be true. By learning from these real-world cases, one can better navigate the complex landscape of blockchain and cryptocurrency.

Inside the Mind of a Scammer: Blockchain Edition

Understanding the mindset of a scammer in the blockchain space is crucial for identifying and preventing fraudulent activities. Scammers often exploit the decentralized and pseudonymous nature of blockchain technology to deceive unsuspecting victims. They employ a variety of tactics to create a facade of legitimacy and lure individuals into their schemes.

One common strategy involves the creation of fake Initial Coin Offerings (ICOs). Scammers design professional-looking websites and whitepapers to present their fraudulent projects as genuine investment opportunities. They often promise high returns and use technical jargon to appear credible. By leveraging social media and online forums, they generate buzz and attract investors who are eager to capitalize on the next big thing in the cryptocurrency world.

Another prevalent method is the use of phishing attacks. Scammers send emails or messages that appear to be from reputable blockchain companies or exchanges. These communications often contain links to fake websites that mimic legitimate platforms. Once users enter their private keys or login credentials, the scammers gain access to their digital wallets and steal their funds.

Ponzi schemes are also a favored tactic among blockchain scammers. These schemes promise high returns with little to no risk, attracting a large number of investors. Early investors are paid with the funds from new investors, creating the illusion of a profitable venture. However, once the flow of new investments slows down, the scheme collapses, leaving the majority of participants with significant losses.

Scammers also exploit the anonymity provided by blockchain technology to conduct exit scams. They launch a seemingly legitimate project, attract substantial investments, and then disappear with the funds. This type of scam is particularly difficult to trace due to the pseudonymous nature of blockchain transactions.

To protect oneself from these scams, it is essential to conduct thorough research before investing in any blockchain project. Verify the credentials of the team behind the project, scrutinize the whitepaper for technical feasibility, and seek out independent reviews. Additionally, be wary of unsolicited communications and always double-check URLs before entering sensitive information.

By understanding the tactics used by scammers and remaining vigilant, individuals can safeguard their investments and contribute to a more secure blockchain ecosystem.

Protecting Your Investments: Recognizing Blockchain Scam Tactics

In the rapidly evolving world of blockchain technology, safeguarding investments is paramount. Recognizing common blockchain scam tactics can help investors avoid falling victim to fraudulent schemes. Scammers often employ sophisticated methods to deceive unsuspecting individuals, making it crucial to stay informed and vigilant.

One prevalent tactic is the phishing scam, where fraudsters create fake websites or send deceptive emails that mimic legitimate blockchain platforms. These counterfeit sites and messages often prompt users to enter sensitive information, such as private keys or passwords, which are then used to steal funds. Always verify the authenticity of websites and emails before providing any personal data.

Another common strategy is the pump and dump scheme. In this scenario, scammers artificially inflate the price of a cryptocurrency through false or misleading statements. Once the price has surged, they sell off their holdings, causing the value to plummet and leaving other investors with significant losses. Be wary of sudden price spikes and conduct thorough research before investing in any digital asset.

Initial Coin Offerings (ICOs) and token sales are also frequent targets for fraud. Scammers may create fake ICOs, promising high returns to lure investors. These fraudulent projects often disappear once they have collected enough funds. To avoid such scams, scrutinize the project’s whitepaper, team credentials, and community feedback.

Social media platforms are another breeding ground for blockchain scams. Fraudsters often impersonate well-known figures or companies, offering fake giveaways or investment opportunities. They may ask for a small fee or personal information in exchange for a larger reward that never materializes. Always verify the legitimacy of such offers through official channels.

Lastly, Ponzi schemes remain a significant threat in the blockchain space. These scams promise high returns with little to no risk, using funds from new investors to pay earlier backers. Eventually, the scheme collapses, leaving the majority of participants with substantial losses. Be cautious of any investment opportunity that guarantees unrealistic returns.

By staying informed about these common blockchain scam tactics, investors can better protect their assets and make more informed decisions. Vigilance and due diligence are essential in navigating the complex landscape of blockchain technology.