Overview of Popular Cryptocurrencies: Bitcoin, Ethereum, Litecoin

- Understanding the Basics of Cryptocurrencies

- Exploring the Origins of Bitcoin, Ethereum, and Litecoin

- Comparing the Key Features of Bitcoin, Ethereum, and Litecoin

- The Rise of Cryptocurrencies in the Digital Economy

- Investing in Bitcoin, Ethereum, and Litecoin: A Beginner’s Guide

- Future Trends and Developments in the Cryptocurrency Market

Understanding the Basics of Cryptocurrencies

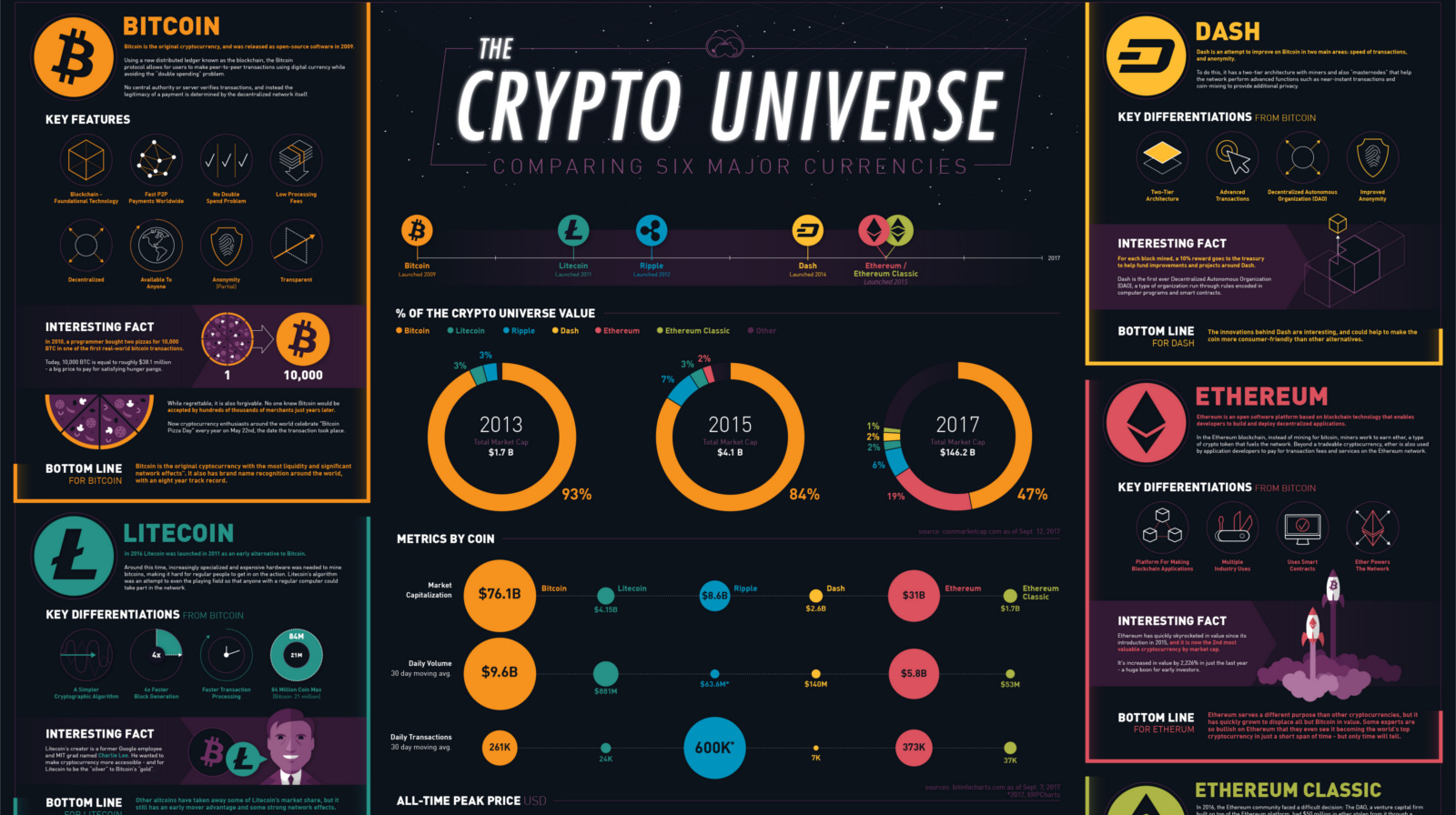

Cryptocurrencies have gained significant popularity in recent years as a digital form of currency that operates independently of a central authority. **Bitcoin**, **Ethereum**, and **Litecoin** are among the most well-known cryptocurrencies in the market. Understanding the basics of cryptocurrencies is essential for anyone looking to invest or trade in these digital assets.

**Cryptocurrencies** are decentralized digital currencies that use cryptography for security and operate on a technology called blockchain. A blockchain is a distributed ledger that records all transactions across a network of computers. This technology ensures transparency, security, and immutability of transactions.

**Bitcoin** was the first cryptocurrency created in 2009 by an unknown person or group of people using the pseudonym **Satoshi Nakamoto**. It remains the most widely recognized and valuable cryptocurrency in terms of market capitalization. **Bitcoin** can be used for online purchases, investment, and as a store of value.

**Ethereum** is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). **Ethereum** introduced the concept of **Ether**, its native cryptocurrency used to power the network and execute smart contracts. **Ethereum** has gained popularity for its versatility and potential for innovation.

**Litecoin** is a peer-to-peer cryptocurrency created by **Charlie Lee** in 2011 as a **fork** of **Bitcoin**. **Litecoin** is often referred to as the silver to **Bitcoin**’s gold and is designed to process transactions faster and with lower fees. **Litecoin** has a strong community and is widely accepted by merchants for payments.

In conclusion, understanding the basics of cryptocurrencies such as **Bitcoin**, **Ethereum**, and **Litecoin** is crucial for anyone interested in participating in the digital currency market. These cryptocurrencies offer unique features and use cases that set them apart in the growing landscape of digital assets.

Exploring the Origins of Bitcoin, Ethereum, and Litecoin

Bitcoin, Ethereum, and Litecoin are three of the most well-known cryptocurrencies in the market today. Each of these digital currencies has its own unique origins that have contributed to their popularity and success in the world of blockchain technology.

Bitcoin, the first cryptocurrency ever created, was introduced in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. The main purpose behind Bitcoin was to create a decentralized digital currency that could be used for peer-to-peer transactions without the need for intermediaries like banks or governments. The blockchain technology underlying Bitcoin has since revolutionized the way we think about money and financial transactions.

Ethereum, on the other hand, was proposed by Vitalik Buterin in late 2013 and development began in early 2014, with the network going live on July 30, 2015. Ethereum is not just a digital currency, but a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). This flexibility and functionality have made Ethereum a popular choice for many blockchain projects and ICOs.

Litecoin, created by Charlie Lee in 2011, was designed to be the “silver” to Bitcoin’s “gold.” It was built on the same fundamental principles as Bitcoin but with some key differences, such as faster transaction times and a different hashing algorithm. Litecoin has gained popularity as a more efficient and cost-effective alternative to Bitcoin for everyday transactions.

Overall, the origins of Bitcoin, Ethereum, and Litecoin highlight the innovative spirit and vision of their creators, who sought to revolutionize the way we think about money, technology, and the future of finance. These cryptocurrencies have paved the way for a new era of digital assets and decentralized systems that continue to shape the world of blockchain technology.

Comparing the Key Features of Bitcoin, Ethereum, and Litecoin

When comparing the key features of Bitcoin, Ethereum, and Litecoin, it is important to consider their unique characteristics that set them apart in the world of cryptocurrencies.

- Bitcoin: Known as the original cryptocurrency, Bitcoin operates on a decentralized network without a central authority. It is primarily used as a store of value and a medium of exchange. Bitcoin transactions are recorded on a public ledger called the blockchain.

- Ethereum: Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). It uses a cryptocurrency called Ether for transactions on the network. Ethereum’s blockchain is also used to power various other tokens and projects.

- Litecoin: Created as a “lighter” version of Bitcoin, Litecoin is known for its faster transaction speeds and lower fees. It is often used for smaller transactions and day-to-day purchases. Litecoin also has a capped supply of 84 million coins, four times more than Bitcoin’s supply.

While all three cryptocurrencies share similarities in terms of being decentralized and using blockchain technology, they each serve different purposes within the crypto ecosystem. Bitcoin is more commonly used as a digital gold or investment asset, Ethereum is focused on smart contracts and dApps, and Litecoin is geared towards faster and cheaper transactions for everyday use.

The Rise of Cryptocurrencies in the Digital Economy

Cryptocurrencies have gained significant traction in the digital economy, revolutionizing the way we perceive and use money. Bitcoin, Ethereum, and Litecoin are among the most popular cryptocurrencies that have seen a surge in adoption and value in recent years.

Bitcoin, often referred to as digital gold, was the first cryptocurrency to be created and remains the most widely recognized and traded. Its decentralized nature and limited supply have contributed to its appeal as a store of value and a medium of exchange in the digital realm.

Ethereum, on the other hand, has gained popularity for its smart contract functionality, allowing developers to build decentralized applications (dApps) on its blockchain. This has led to a vibrant ecosystem of projects and tokens, further solidifying Ethereum’s position in the cryptocurrency market.

Litecoin, often dubbed as the silver to Bitcoin’s gold, was created as a faster and more scalable alternative to Bitcoin. With quicker transaction times and lower fees, Litecoin has carved out its niche in the cryptocurrency space, appealing to users looking for a more efficient payment solution.

Overall, the rise of cryptocurrencies in the digital economy has opened up new possibilities for financial transactions, investments, and technological innovations. As more people and businesses embrace the potential of cryptocurrencies, their impact on the global economy is only expected to grow in the coming years.

Investing in Bitcoin, Ethereum, and Litecoin: A Beginner’s Guide

When it comes to investing in Bitcoin, Ethereum, and Litecoin, it’s essential to understand the basics before diving in. These cryptocurrencies have gained popularity in recent years, attracting both seasoned investors and beginners looking to capitalize on the digital currency market.

Before you start investing in Bitcoin, Ethereum, or Litecoin, it’s crucial to do your research and understand how each cryptocurrency works. Bitcoin is the first and most well-known cryptocurrency, often referred to as digital gold. Ethereum is a decentralized platform that enables smart contracts and decentralized applications to be built and operated without any downtime, fraud, control, or interference from a third party. Litecoin is a peer-to-peer cryptocurrency created by Charlie Lee that enables instant, near-zero cost payments to anyone in the world.

When investing in Bitcoin, Ethereum, or Litecoin, it’s essential to consider factors such as market volatility, regulatory developments, and technological advancements. Diversifying your investment portfolio with a mix of cryptocurrencies can help mitigate risk and maximize potential returns.

Future Trends and Developments in the Cryptocurrency Market

The cryptocurrency market is constantly evolving, with new trends and developments shaping the future of digital currencies. One of the key trends to watch out for is the increasing adoption of cryptocurrencies by mainstream financial institutions. As more traditional banks and investment firms start to embrace digital assets like Bitcoin, Ethereum, and Litecoin, we can expect to see a surge in demand for these cryptocurrencies.

Another important development in the cryptocurrency market is the rise of decentralized finance (DeFi) platforms. These platforms allow users to access a wide range of financial services without the need for traditional intermediaries like banks. DeFi has the potential to revolutionize the way we think about finance, and many experts believe that it will play a significant role in the future of cryptocurrencies.

One of the most exciting trends in the cryptocurrency market is the growing interest in non-fungible tokens (NFTs). These unique digital assets have gained popularity in recent years, with artists, musicians, and other creators using them to monetize their work. NFTs are built on blockchain technology, making them secure and transparent, and they have the potential to disrupt the traditional art and entertainment industries.