Cryptocurrency Regulation: Overview of legislation in different countries

- Introduction to Cryptocurrency Regulation

- Legislation in the United States

- Regulatory Framework in the European Union

- Cryptocurrency Laws in Asia

- Challenges and Opportunities in Regulation

- Future Trends in Cryptocurrency Legislation

Introduction to Cryptocurrency Regulation

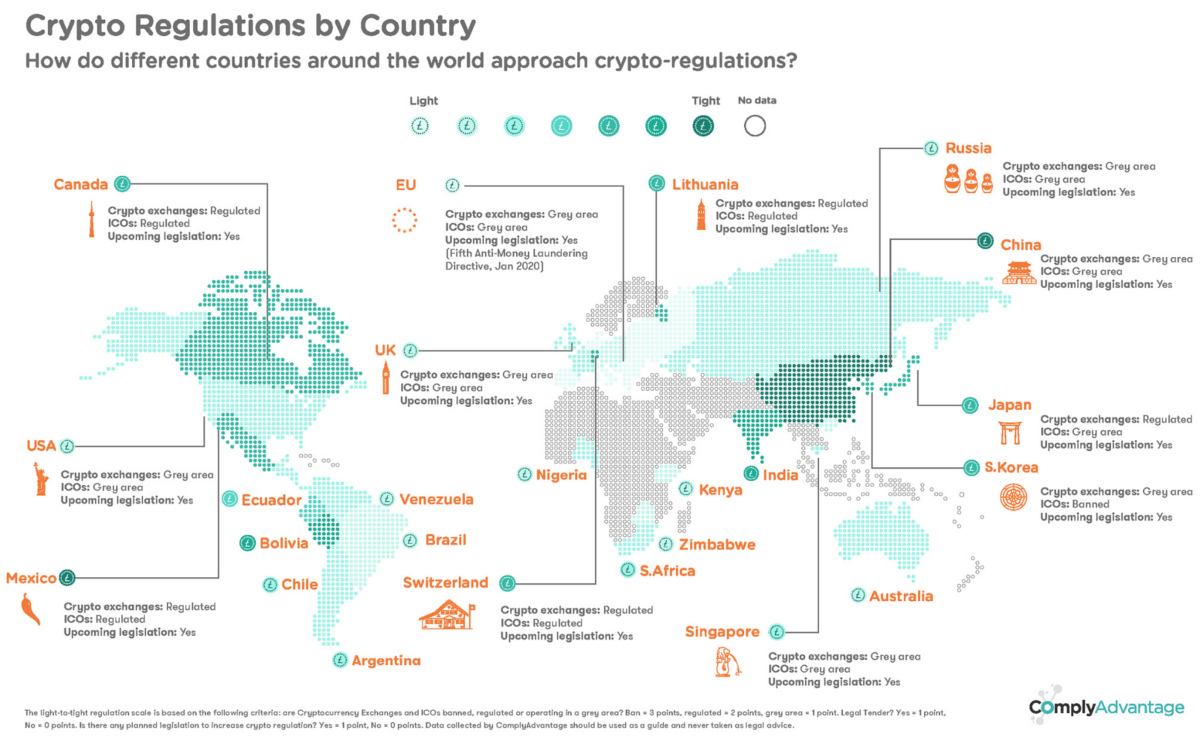

Cryptocurrency regulation is a complex and evolving landscape that varies significantly from country to country. Governments around the world are grappling with how to regulate this new form of digital currency, balancing the need to protect consumers and prevent illicit activities while also fostering innovation and growth in the industry.

In recent years, there has been a surge in interest and investment in cryptocurrencies, leading many countries to develop regulatory frameworks to govern their use. Some countries have embraced cryptocurrencies, while others have taken a more cautious approach, imposing strict regulations or outright bans.

Regulation of cryptocurrencies typically falls under the purview of financial regulatory bodies or central banks. These agencies are responsible for overseeing the use of cryptocurrencies, ensuring compliance with anti-money laundering (AML) and know your customer (KYC) regulations, and protecting consumers from fraud and scams.

As the popularity of cryptocurrencies continues to grow, regulators are faced with the challenge of keeping pace with technological advancements and emerging trends in the industry. It is essential for regulators to strike a balance between fostering innovation and protecting consumers, creating a regulatory environment that is conducive to the growth of the cryptocurrency market.

Legislation in the United States

In the United States, the regulation of cryptocurrency is a complex and evolving landscape. Various government agencies have taken different approaches to overseeing the use of digital currencies. The Securities and Exchange Commission (SEC) has been actively involved in regulating initial coin offerings (ICOs) and classifying certain cryptocurrencies as securities. The Commodity Futures Trading Commission (CFTC) has also played a role in overseeing cryptocurrency derivatives trading.

Additionally, individual states have started to implement their own regulations regarding cryptocurrencies. For example, New York has introduced the BitLicense, which requires companies dealing with virtual currencies to obtain a license in order to operate in the state. Other states have taken different approaches, with some being more lenient and others imposing stricter regulations.

Overall, the regulatory environment for cryptocurrencies in the United States is still in a state of flux. As the technology continues to evolve and gain mainstream acceptance, it is likely that more comprehensive regulations will be put in place to protect consumers and investors. It is important for businesses operating in the cryptocurrency space to stay informed about the latest developments in regulation to ensure compliance with the law.

Regulatory Framework in the European Union

The regulatory framework in the European Union regarding cryptocurrency is a complex and evolving landscape. The EU has taken a cautious approach to regulating cryptocurrencies, aiming to strike a balance between fostering innovation and protecting consumers.

One of the key pieces of legislation in the EU is the Fifth Anti-Money Laundering Directive (5AMLD), which came into effect in January 2020. This directive requires cryptocurrency exchanges and wallet providers to conduct customer due diligence and report suspicious transactions to the relevant authorities.

In addition to the 5AMLD, the EU has also been working on a comprehensive regulatory framework for cryptocurrencies. The European Commission has proposed a regulation on Markets in Crypto-Assets (MiCA), which aims to provide legal certainty for issuers and service providers in the crypto space.

Overall, the EU’s approach to cryptocurrency regulation is focused on promoting innovation while ensuring consumer protection and financial stability. As the crypto market continues to grow and evolve, it will be crucial for regulators to adapt and update the regulatory framework to address new challenges and risks.

Cryptocurrency Laws in Asia

In Asia, the regulation of cryptocurrencies varies significantly from country to country. Some nations have embraced digital currencies, while others have taken a more cautious approach. Here is an overview of the cryptocurrency laws in different Asian countries:

1. **Japan**: Japan is one of the most cryptocurrency-friendly countries in Asia. In 2017, the Japanese government officially recognized Bitcoin as a legal form of payment. The country has a well-established regulatory framework for cryptocurrencies, which has helped to foster innovation in the industry.

2. **South Korea**: South Korea has also been relatively open to cryptocurrencies, but the government has implemented stricter regulations in recent years. Cryptocurrency exchanges in South Korea are required to comply with anti-money laundering (AML) and know your customer (KYC) regulations.

3. **China**: China has taken a more hardline stance on cryptocurrencies. In 2017, the Chinese government banned initial coin offerings (ICOs) and shut down cryptocurrency exchanges. However, the country has been exploring the possibility of launching its own digital currency.

4. **Singapore**: Singapore has emerged as a hub for cryptocurrency and blockchain technology in Asia. The country has a progressive approach to regulating cryptocurrencies, with a focus on consumer protection and preventing financial crimes.

5. **India**: India has had a tumultuous relationship with cryptocurrencies. The Reserve Bank of India (RBI) banned banks from dealing with cryptocurrency businesses in 2018, but the Supreme Court overturned the ban in 2020. The Indian government is currently considering a bill that would ban all private cryptocurrencies.

Overall, the regulatory landscape for cryptocurrencies in Asia is complex and constantly evolving. While some countries have embraced digital currencies, others have implemented strict regulations to protect consumers and prevent illicit activities. It is essential for anyone involved in the cryptocurrency industry to stay informed about the laws and regulations in their respective countries.

Challenges and Opportunities in Regulation

Regulating cryptocurrencies presents a unique set of challenges and opportunities for governments around the world. On one hand, the decentralized nature of cryptocurrencies makes it difficult for regulators to monitor and control their use. This can lead to concerns about illegal activities such as money laundering and tax evasion. On the other hand, cryptocurrencies also offer opportunities for innovation and financial inclusion.

One of the main challenges in regulating cryptocurrencies is the lack of a unified approach among countries. Each country has its own set of regulations, which can create confusion for businesses and users operating across borders. Additionally, the rapid pace of technological change in the cryptocurrency space means that regulations can quickly become outdated.

Despite these challenges, there are also opportunities for regulators to create a framework that balances innovation with consumer protection. By working with industry stakeholders and international partners, regulators can develop policies that promote the growth of the cryptocurrency market while mitigating risks.

Future Trends in Cryptocurrency Legislation

As the cryptocurrency market continues to evolve, there is a growing need for legislation to keep pace with these changes. Governments around the world are starting to recognize the importance of regulating cryptocurrencies to protect investors and prevent illegal activities. Here are some future trends in cryptocurrency legislation:

- Increased Regulation: Many countries are expected to introduce stricter regulations on cryptocurrencies to combat money laundering, fraud, and other illicit activities. This could involve requiring cryptocurrency exchanges to adhere to the same anti-money laundering (AML) and know your customer (KYC) regulations as traditional financial institutions.

- Taxation: Governments are also looking into how to tax cryptocurrencies, as they become more mainstream. This could involve treating cryptocurrencies as property for tax purposes, similar to stocks or real estate.

- Consumer Protection: There is a growing concern about the lack of consumer protection in the cryptocurrency market. Future legislation may focus on ensuring that investors are adequately informed about the risks associated with cryptocurrencies and have recourse in case of fraud or theft.

- Global Cooperation: Given the borderless nature of cryptocurrencies, there is a need for international cooperation in regulating the market. Countries may work together to create common standards and regulations to prevent regulatory arbitrage.

- Innovation: While regulation is necessary to protect investors, there is also a recognition of the need to foster innovation in the cryptocurrency space. Future legislation may aim to strike a balance between regulation and allowing for technological advancements.